Since the government first revealed its plan for offering state-run companies on the stock market in July 2015, many changes occurred in the plan and changes in the officials responsible for the IPO programme, while the local market still awaits this step.

The story began when the government announced its desire to offer three companies on the stock market, before it became a key part of the country’s economic reform programme orchestrated with the International Monetary Fund (IMF). Some changes were made to the programme’s goals, including the development of government companies, improving their performance, easing the financial burden on the state, and reducing its role in the national economy.

The past three years were full of confusion, lack of vision, and the unwillingness of officials to get involved in a programme that previously proved its legal complications, to the extent that officials may go to prison for unexpected reasons.

The past three years were full of confusion, lack of vision, and the unwillingness of officials to get involved in a programme that previously proved its legal complications, to the extent that officials may go to prison for unexpected reasons.

A senior government official, who spoke on condition of anonymity, acknowledged the difficulties encountered in the government’s IPO programme, saying that the fear of legal consequences hindered the launch of the programme until former Prime Minister Sherif Ismail issued a decision in May to reorganise the provisions of the programme to activate the Egyptian stock market and expand the ownership base.

Offering state assets is always questionable in Egypt and attacked by media and judicial authorities. Several verdicts were issued ordering return of state-run companies that had already been sold following the political turmoil in 2011. Some of these verdicts were impossible to apply because such companies are even sold several times or offered on the stock market, where they were traded every day for several years.

The official said that the management boards of some companies set for offering refused to approve certain procedures to avoid legal accountability, while some heads of these companies were close to the age of retirement and preferred not to make a decision on the issue, instead leaving it to the successor.

Word spread about the government IPO programme started on 7 July 2015 when former Minister of Investment Ashraf Salman, quoted by Daily News Egypt, said that the government will offer three of its companies before the end of that year to activate the stock market, and that move has not been accomplished so far.

It took Salman six months to announce that Misr Insurance will be the first state-run company to be offered on the stock market. After several months, Salman left the government. The programme remained in shadows for almost a year until the end of 2016, when it became part of the IMF-aided economic reform programme. Then, former Minister of Investment Dalia Khorshid named three companies to be offered: Alexandria Mineral Oils Company (AMOC), Sidi Kerir Petrochemicals Company (SIDPEC), and Engineering for the Petroleum and Process Industries (ENPPI). Khorshid added that the offering rates will range between 20% and 30%, which did not happen so far.

In February 2017, Khorshid left her position, and her successor, Sahar Nasr, failed to make any progress on the issue until the end of the year when the file was transferred from the Ministry of Investment to the Ministry of Finance. Several months later, the Ministry of Finance announced a road map including the number of companies to be offered and a timetable for the offering, with the expected revenue and offering ratios, giving an optimistic impression that something different will happen.

Confusion

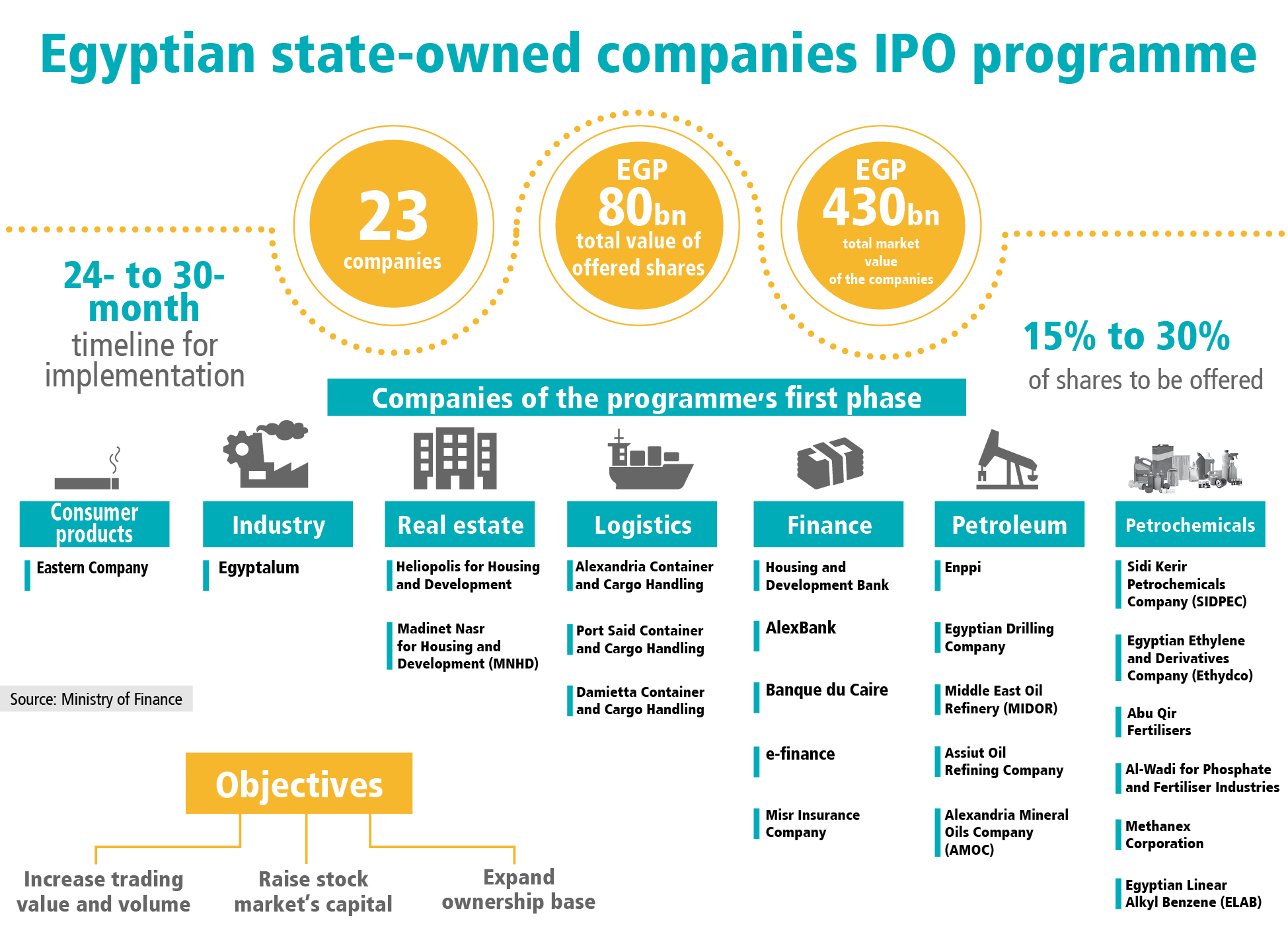

The first phase of the road map was revealed on 18 March, including selling minority stakes of 23 companies in different sectors, some of which were already listed on the stock market, and others were closed within 30 months, with an expected revenue of EGP 80bn.

However, two months later, there was no progress and the cabinet intervened to solve the case, which became more confusing.

Former Prime Minister Ismail issued a decision to form a committee of six ministers to develop a comprehensive IPO programme of the state-owned companies, set a new timetable for its implementation, and followed up on the whole process.

The committee was also authorised to choose the state-owned companies that will be offered on the stock market or whose ownership base will be expanded. The committee can also recall the concerned ministers or legal representatives of the relevant bodies to discuss issues related to the offering process. It also can appoint experienced advisors to help in supervising the offering process. The committee shall have a technical secretariat headed by the minister of finance, and he will be responsible for forming it.

It means that the programme became the responsibility of the whole government, not a certain ministry. The decision also addressed the valuation of companies, the most sensitive aspect in the programme.

The decision allowed the minister of finance to form one or more committees to approve the valuation studies of the state-owned companies, headed by one of the vice-presidents of the State Council, and with the membership of representatives of the Ministry of Finance, the Central Auditing Organisation, the Administrative Control Authority, the Central Bank of Egypt, the Egyptian Society of Accountants and Auditors, the equity holders of targeted companies, and the holding companies of the targeted companies.

The ministerial committee consists of ministers of investment and international cooperation; petroleum and mineral wealth; trade and industry; finance; planning, follow-up and administrative reform; and public business sector, as well as the head of the secretariat of the cabinet’s legislative affairs.

The official added that one of the targeted companies in the government IPO programme faced a problem, as its management board refused to approve offering procedures, prompting the president to intervene and solve the problem.

Meanwhile, Egypt announced its latest ministerial reshuffle, in which newly appointed prime minister and acting minister of housing, Moustafa Madbouly and Finance Minister Mohamed Moeit were tasked with the activation and acceleration of the IPO programme.

The new government adopted a new approach in offering government companies through selling shares of companies already listed on the stock market that belong to the Ministry of Public Sector Affairs. Hence, the new minister of public sector affairs, Hesham Tawfik, became an important partner in the IPO programme.

“We were tasked with speeding up the implementation of the government IPO programme to maintain state credibility in front of foreign investors,” said the official.

Moeit denied that the government is hesitating about offering state-run companies on the stock market, especially those that will be offered for the first time.

The minister told DNE that the government adopts well-studied steps in offering the state-owned companies to ensure the success of the programme.

He pointed out that “the government does not give precedence to certain companies over others, and we are fully aware of financial, legal, procedural, and executive requirements for offering the suitable companies,” adding, “we have the required expertise for the IPO process and know the legal procedures to be followed in such cases.”.

He noted that the ministry has many perceptions of the government IPO programme and communicates with investment banks, investors, and legal offices.

Other reasons behind programme’s delay

Among the companies that were targeted in the government IPO programme, Enppi and Banque du Caire were included in the first phase of the programme. The two companies have already been listed on the stock market, but the actual offering was postponed several times and nothing happened on the ground so far. They are also expected to be delayed to the next year at least, after the government preferred to start offering shares of the companies already listed on the stock market.

The government contracted with HSBC and EFG-Hermes as financial advisers, and Baker McKenzie as legal adviser to Banque du Caire in April last year, while CI Capital, Jeffrey Matthews, and Emirates NBD were chosen as financial advisers and Baker McKenzie as legal adviser to Enppi in July of the same year.

Sources close to the IPO of Enppi said that the company’s contributions to its 10s of subsidiaries and associates slowed the offering process, because the inventory and evaluation of all these contributions require a long time to determine the total value of the company.

Mohamed Abu Pasha, vice president of the research department at EFG-Hermes, said that the recent ministerial reshuffle delayed the offering because the new ministers needed some time to study the programme, while a number of the targeted companies were not ready for the offering process, and some of needed between four and six months for restructuring.

He added that the public sector companies that are not listed on the stock market will need more than six months to prepare and restructure them; therefore, the government programme started with the companies that are actually listed on the stock market, such as Eastern Company.

Abu Pasha praised the government IPO programme, describing it as a positive move since it does not aim to sell the companies, but attract new investments to finance their expansion plans, similar to Eastern European countries, the Netherlands, and Ukraine.

Perfect timing

Mohamed Gabr, legal partner at Al Tamimi & Company for legal consultancy, said that the current conditions in Egypt are not conducive to the government IPO programme in light of the absence of large offerings by the private sector companies, noting that the stock market has witnessed only two offerings this year so far.

He added that the government companies should be offered during the boom periods of the capital markets. He pointed out that the laws regulating the IPO process set special standards for the evaluation process, dealing with government assets, and negotiation procedures, whether through the competent minister or the affiliated committee that supervises the IPO process.

Gabr said that the success of the IPO programme relies on the attractive valuation to ensure selling the shares more than once and thus increasing their values after the IPO, adding that the private sector has greater flexibility in the valuation process compared to government companies.

He demanded that the government’s valuation of its listed companies should be logical and technically disciplined to ensure the success of future offerings.

Hatem El Hady, managing director of FINCORP for financial consultancy, said the government IPO programme is characterised by high transparency, as the cabinet has announced the names of the targeted companies.

He added that they faced some problems in the evaluation process of the previous government IPOs that led to a number of crises, such as Omar Effendi and other companies that returned to the state upon judicial rulings, because the evaluations were conducted by certain advisory offices.

El Hady said there should be no legal concerns about the IPO process, as long as there are accurate regulatory procedures determining the responsibilities of each member in the process. He stated that the heads of government companies have nothing to do with the valuation process, as long as they followed the right procedures to choose the financial advisers of the offering.

He pointed out that the government aims through this programme to find a radical solution to the problems of state-run companies, noting that the government chose large companies in the banking and petrochemical sectors.

Regarding the offering of listed companies instead of new government companies, El Hady said that it depends on several considerations—mainly that listed companies are already valued on the stock market and their offering procedures will not take a long time.

He pointed out that one of the IPO programme’s goals is changing the targeted government companies’ management boards, which will improve their performance.

Searching for a start

Sherif Samy, former head of the Financial Supervisory Authority, said the most important challenge facing the government is to implement the programme on schedule, because the frequent postponement of the programme affects its credibility, especially, since the file was transferred between several governments.

Samy called for objective valuation of government companies, so that both the government and investors can make profits.

He pointed out that the offering programme is not the responsibility of one individual, but a ministerial committee that includes the prime minister and the president, which fortifies the programme from any prosecutions.

In 2013, the state was working on protecting government contracts from prosecutions that can harm investors and senior officials. Former President Adly Mansour had issued a decree prohibiting appeals against state contracts; however the decree has since then been appealed.

The government decided to launch the IPO programme next month through offering a stake in one of the five public business sector companies that are already listed on the stock market.

In October, the government will offer stakes from Heliopolis Company for Housing and Development, as well as the Eastern Company. In November, more shares will be offered from Alexandria Mineral Oils Company (AMOC) and Alexandria Container and Cargo Handling Company (ALCN). In December, a stake will be offered from Sidi Kerir Petrochemical Company (SIDPEC).

Mohamed Abu El Gheit, managing director of Pioneers Holding Company for Financial Investment, said that the five targeted companies represent different sectors, such as petrochemicals, housing, shipping and fertilisers, noting that these are vital and strategic sectors that can attract investors, especially if they were offered at a reasonable price.

He added that the success of the programme relies on taking into account the time period separating the offerings in a way that facilitates the implementation of the rest of the programme.

Noha al-Ghazali, managing director of Pharos Holding for Financial Investments, said that the selection of the five companies relied on the fact that they were already listed on the stock market, unlike the other companies in the programme that need to be listed and prepared for offering.